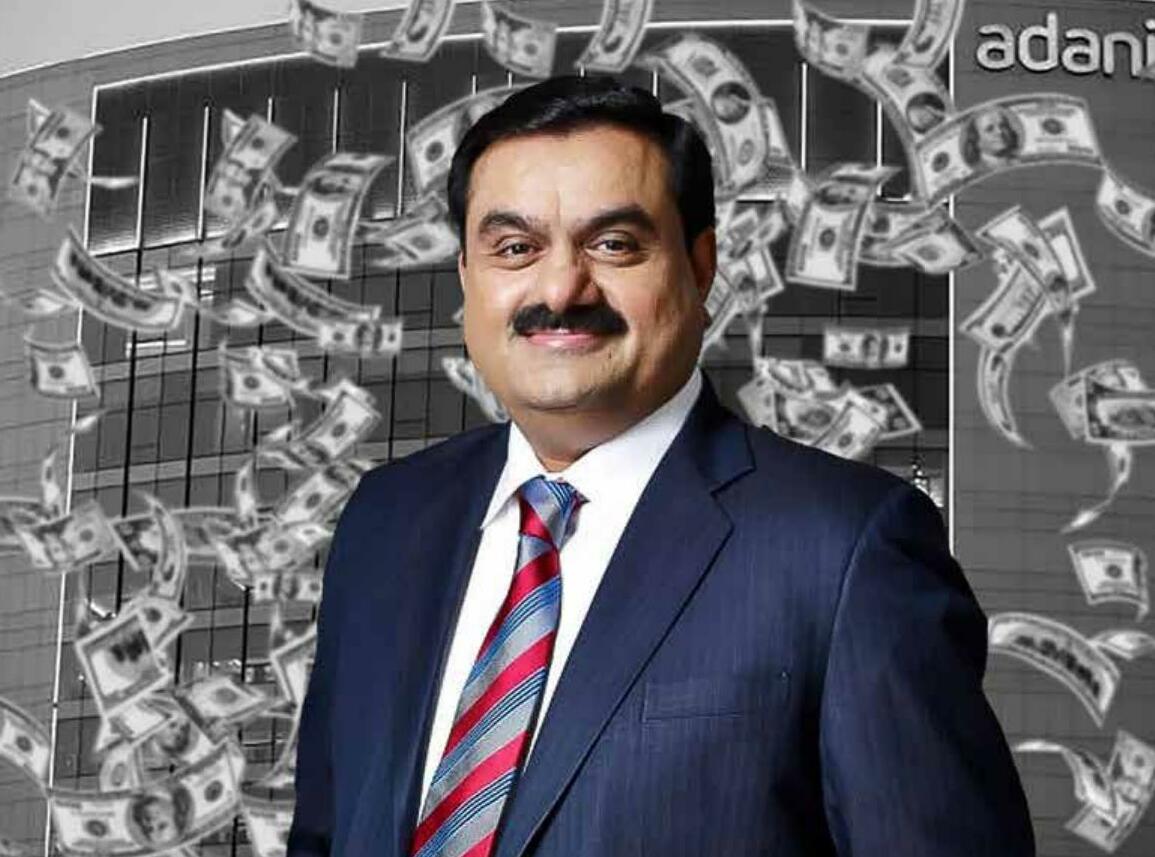

Gautam Adani Faces U.S. Fraud Charges, Adani Stocks Tumble by 20%

Indian tycoon Gautam Adani, one of Asia’s wealthiest individuals, is back under scrutiny as U.S. prosecutors unveiled charges of securities fraud and conspiracy. Adani, 62, is accused of misleading investors in a large-scale solar energy project in India, allegedly linked to a bribery scheme, according to reports.

Following the indictment in New York, shares of Adani’s companies dropped sharply, with some seeing losses of up to 20% on Thursday. The legal action also led the Adani Group to scrap plans for a U.S. dollar-denominated bond offering.

Adani Group in a statement stated that the allegations made by the US Department of Justice and the US Securities and Exchange Commission against directors of Adani Green are baseless and denied.

As stated by the US Department of Justice itself, “the charges in the indictment are allegations and the defendants are presumed innocent unless and until proven guilty.” All possible legal recourse will be sought.

The Adani Group has always upheld and is steadfastly committed to maintaining the highest standards of governance, transparency and regulatory compliance across all jurisdictions of its operations. We assure our stakeholders, partners and employees that we are a law-abiding organisation, fully compliant with all laws.