Understanding the 50/30/20 Rule in Personal Finance

Personal finance can often seem overwhelming, but simple strategies can make managing your money much easier. One such strategy is the 50/30/20 rule, a budgeting method that helps individuals allocate their income efficiently. This rule is easy to follow and can lead to more disciplined spending and saving habits. Here’s an in-depth look at the 50/30/20 rule and how you can apply it to your financial planning.

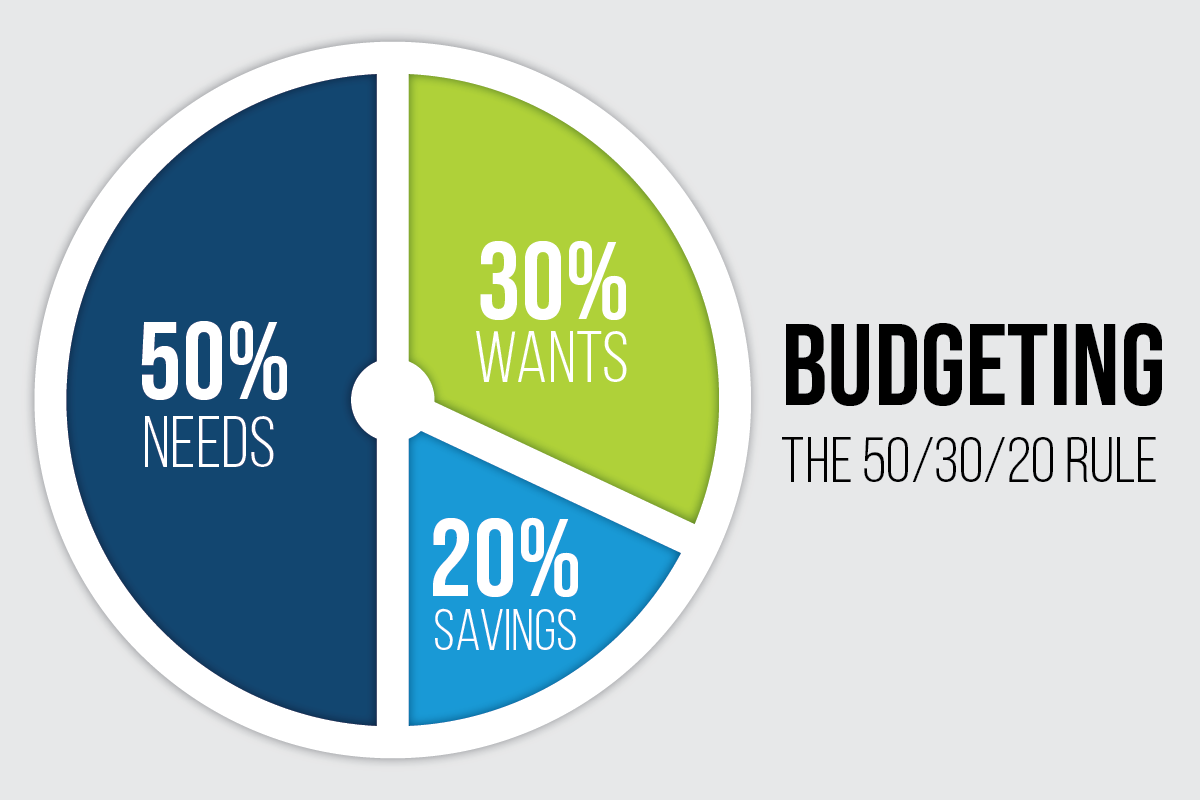

What is the 50/30/20 Rule?

The 50/30/20 rule is a budgeting guideline that divides your after-tax income into three categories:

- Needs (50%)

- Wants (30%)

- Savings and Debt Repayment (20%)

1. Needs (50%)

Half of your income should be allocated to essential expenses—those that are necessary for survival and basic well-being. These include:

- Housing costs (rent or mortgage payments)

- Utilities (electricity, water, gas)

- Groceries

- Transportation (car payments, public transit)

- Insurance (health, auto, home)

- Minimum debt payments

- Healthcare costs

These are non-negotiable expenses that you need to cover to maintain a basic standard of living. It’s crucial to distinguish between needs and wants to ensure that this category only includes essential expenditures.

2. Wants (30%)

The next 30% of your income should go towards wants—expenses that enhance your lifestyle but are not essential. These include:

- Dining out and entertainment

- Hobbies and leisure activities

- Vacations

- Subscriptions (streaming services, magazines)

- Shopping for non-essential items (clothing, gadgets)

Wants can often blur the line with needs, so it’s important to be honest with yourself about what truly constitutes a want. This category allows you to enjoy life and indulge in luxuries without compromising your financial stability.

3. Savings and Debt Repayment (20%)

The final 20% of your income should be directed towards financial goals, which include:

- Building an emergency fund

- Contributing to retirement accounts (401(k), IRA)

- Paying off debt beyond the minimum payments

- Saving for future expenses (home purchase, education)

- Investing in stocks, bonds, or other assets

This category focuses on securing your financial future and ensuring you have a safety net in case of unexpected expenses.

How to Implement the 50/30/20 Rule

- Calculate Your After-Tax Income: Determine your total income after taxes. This is the amount you have available for allocation into the three categories.

- Track Your Expenses: Monitor your spending for a month to see how much you currently spend on needs, wants, and savings/debt repayment. This will help you identify areas where you can adjust your spending to fit the 50/30/20 rule.

- Adjust Your Budget: Based on your expense tracking, adjust your spending to align with the 50/30/20 rule. This might involve cutting down on non-essential spending or finding ways to reduce necessary expenses.

- Automate Savings and Debt Payments: Set up automatic transfers to your savings accounts and automatic payments for debt repayment. This ensures that you consistently allocate the necessary funds towards your financial goals.

- Review Regularly: Periodically review your budget to ensure you are staying on track and make adjustments as needed. Life circumstances and financial goals can change, so it’s important to stay flexible.

Benefits of the 50/30/20 Rule

- Simplicity: The rule is straightforward and easy to follow, making it accessible for everyone, regardless of financial expertise.

- Balance: It provides a balanced approach to managing money, allowing you to cover essentials, enjoy life, and save for the future.

- Flexibility: The rule can be adjusted to fit individual circumstances and financial goals.

The 50/30/20 rule is a practical and effective method for managing your finances. By dividing your income into needs, wants, and savings, you can create a balanced budget that supports your current lifestyle and future financial goals. Whether you’re new to budgeting or looking to refine your financial strategy, the 50/30/20 rule offers a simple yet powerful framework to help you achieve financial stability and succes