How To Build Generational Wealth and Plan for Retirement at the Same Time

Building generational wealth and planning for retirement are two important financial goals that many individuals strive to achieve. While they may seem like separate objectives, it is possible to work towards both simultaneously. By adopting a strategic approach and making smart financial decisions, you can build wealth that not only benefits you during your retirement years but also provides a lasting legacy for future generations.

1. Start Early and Save Consistently

One of the key factors in building generational wealth and planning for retirement is to start early and save consistently. The power of compound interest can significantly impact your savings over time. By starting early, you allow your investments to grow and compound over several decades, maximizing your returns.

Make it a habit to save a portion of your income regularly. Set up automatic contributions to your retirement accounts, such as a 401(k) or an IRA. Aim to save at least 10-15% of your income, if possible. The earlier you start and the more consistently you save, the better positioned you will be to build wealth for both your retirement and future generations.

2. Diversify Your Investments

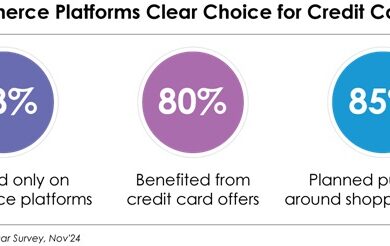

While saving is important, it is equally important to invest your savings wisely. Diversifying your investments is a crucial strategy for building generational wealth. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds, you can reduce risk and potentially increase your returns.

Consider working with a financial advisor who can help you create a diversified investment portfolio tailored to your financial goals and risk tolerance. Regularly review and rebalance your portfolio to ensure it remains aligned with your objectives and market conditions.

3. Educate Yourself and Seek Professional Advice

Building generational wealth and planning for retirement require financial literacy and knowledge. Educate yourself about different investment vehicles, tax strategies, and estate planning. Stay informed about market trends and economic indicators that may impact your investments.

Additionally, seek professional advice from experts in the field. Financial advisors, estate planners, and tax professionals can provide valuable guidance and help you make informed decisions. They can assist you in creating a comprehensive financial plan that addresses both your retirement needs and generational wealth goals.

4. Incorporate Estate Planning

Estate planning is a crucial component of building generational wealth. It involves creating a plan for the distribution of your assets after your passing. By carefully considering your estate plan, you can ensure that your wealth is transferred to future generations in a tax-efficient manner.

Work with an estate planning attorney to draft a will, establish trusts, and designate beneficiaries. Consider the use of tools such as life insurance policies and gifting strategies to minimize estate taxes and provide for your loved ones.

5. Teach Financial Responsibility to Future Generations

Building generational wealth goes beyond just accumulating assets. It also involves instilling financial responsibility and knowledge in future generations. Teach your children and grandchildren about the importance of saving, investing, and making wise financial decisions.

Encourage them to develop good money management habits and provide them with opportunities to learn about personal finance. By equipping future generations with financial literacy, you can help ensure the longevity of your family’s wealth.

Conclusion

Building generational wealth and planning for retirement are not mutually exclusive goals. By starting early, saving consistently, diversifying investments, seeking professional advice, incorporating estate planning, and teaching financial responsibility, you can work towards both objectives simultaneously. Remember, building generational wealth is a long-term endeavor that requires discipline, patience, and strategic planning. Start today and lay the foundation for a financially secure future for yourself and future generations.