Money

-

Ola Electric IPO Fully Subscribed on Day Two, Attracts Strong Investor Interest

The initial public offering (IPO) of Ola Electric has garnered full subscription on the second day of its bidding process, following a 35% subscription on the first day. The issue received bids for 49,43,85,840 shares, amounting to 1.06 times the issue size of 46,51,59,451 shares. The retail individual investor (RII) quota was notably oversubscribed at 2.87 times, while the non-institutional…

Read More » -

Top-Performing Mutual Funds in 2024: Based on Historical Performance

As we navigate the investment landscape in 2024, Indian investors are seeking mutual funds with proven track records. We’ve compiled a list of top-performing funds across various categories, based on their historical returns. Remember, while past performance doesn’t guarantee future results, it can be a useful indicator of a fund’s potential. Equity Funds: Consistent Performers Axis Bluechip Fund – Direct…

Read More » -

Top Mutual Funds to Invest In: A Comprehensive Guide

Mutual funds offer a diverse range of investment opportunities, pooling money from many investors to invest in various securities. Choosing the right mutual fund can be challenging given the numerous options available. This guide will highlight some of the top mutual funds to consider for investment, taking into account various factors such as performance, risk, and investment goals. Key Considerations…

Read More » -

Build Wealth Effortlessly with Systematic Investment Plans (SIPs)

What is a Systematic Investment Plan (SIP)? A Systematic Investment Plan (SIP) is a method of investing in mutual funds where an investor regularly contributes a fixed amount of money at predetermined intervals (usually monthly). This approach allows investors to benefit from rupee cost averaging and helps in building wealth over time. Key Features of SIPs Regular Investments: SIPs involve…

Read More » -

Mutual Funds : Why Index Funds Are the Future of Investing

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to replicate the performance of a specific market index. A market index tracks the performance of a group of assets representing a segment of the financial market. Common examples of market indexes include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite. How Do…

Read More » -

RBI Tell Banks, NBFC to Scrutinize Potential “Wilful Default” Cases in NPA

The Reserve Bank of India (RBI) has issued new guidelines urging banks and Non-Banking Financial Companies (NBFCs) to scrutinize potential ‘wilful default’ cases in non-performing asset accounts with outstanding amounts of Rs 25 lakh and above. These directives, outlined in RBI’s latest Master Direction on the Treatment of Wilful Defaulters and Large Defaulters, will be applicable to all regulated entities…

Read More » -

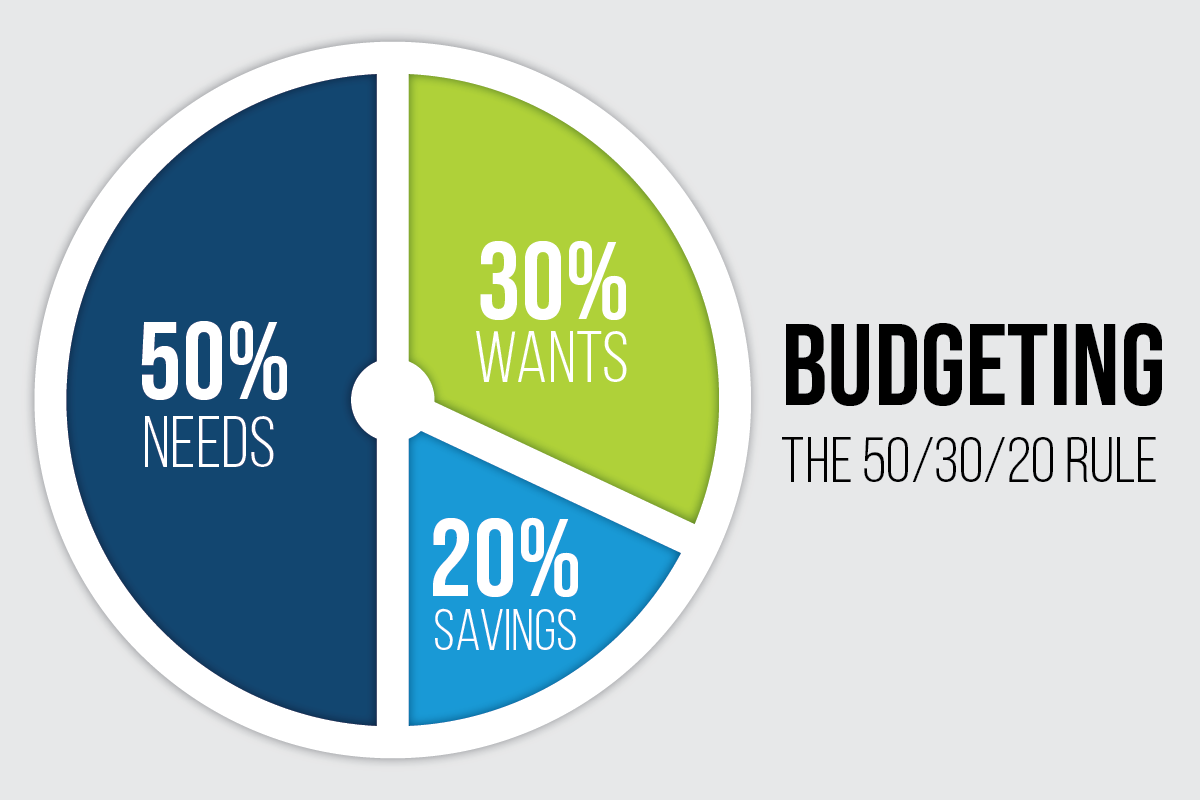

Understanding the 50/30/20 Rule in Personal Finance

Personal finance can often seem overwhelming, but simple strategies can make managing your money much easier. One such strategy is the 50/30/20 rule, a budgeting method that helps individuals allocate their income efficiently. This rule is easy to follow and can lead to more disciplined spending and saving habits. Here’s an in-depth look at the 50/30/20 rule and how you…

Read More » -

Budgeting Without the Burden: New Approaches to Financial Planning

In today’s fast-paced financial world, creating a realistic budget is like having a roadmap for your money. It’s an essential skill that can transform your financial health and pave the way to your long-term goals. But how do you craft a budget that’s both effective and sustainable? Let’s dive into the process. Start with Your Income The foundation of any…

Read More » -

Earn More on Idle Cash: Invest in Liquid and Overnight Funds

Most of us keep money sitting idle in our savings bank accounts, enjoying the convenience of easy access for paying utility bills, credit card bills, and other expenses via debit card or cheque. However, this practice comes with a hidden cost. Savings accounts typically offer interest rates of 3.50-4%, which often fail to keep up with inflation. Consequently, while these…

Read More » -

Unlock 9% Returns: Top Banks Offering High-Interest FDs for Seniors

Banks Introduce Special Fixed Deposit Schemes for Senior Citizens with Attractive Interest Rates In a move to attract senior citizen investors, several banks have launched special fixed deposit schemes offering higher interest rates. For senior citizens, who typically prioritize stability and consistent income through interest payments post-retirement, these schemes present a compelling option. Despite the taxable nature of interest earned…

Read More »