Investing

-

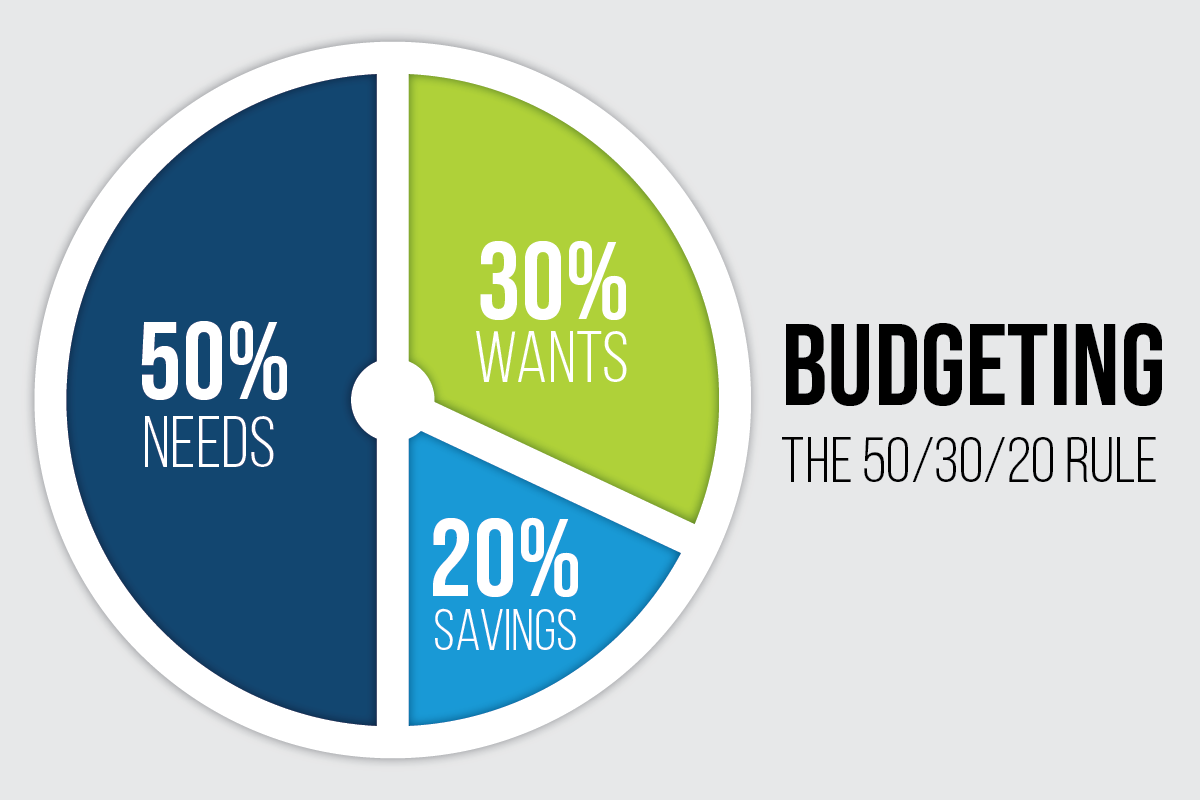

Understanding the 50/30/20 Rule in Personal Finance

Personal finance can often seem overwhelming, but simple strategies can make managing your money much easier. One such strategy is the 50/30/20 rule, a budgeting method that helps individuals allocate their income efficiently. This rule is easy to follow and can lead to more disciplined spending and saving habits. Here’s an in-depth look at the 50/30/20 rule and how you…

Read More » -

Earn More on Idle Cash: Invest in Liquid and Overnight Funds

Most of us keep money sitting idle in our savings bank accounts, enjoying the convenience of easy access for paying utility bills, credit card bills, and other expenses via debit card or cheque. However, this practice comes with a hidden cost. Savings accounts typically offer interest rates of 3.50-4%, which often fail to keep up with inflation. Consequently, while these…

Read More » -

Unlock 9% Returns: Top Banks Offering High-Interest FDs for Seniors

Banks Introduce Special Fixed Deposit Schemes for Senior Citizens with Attractive Interest Rates In a move to attract senior citizen investors, several banks have launched special fixed deposit schemes offering higher interest rates. For senior citizens, who typically prioritize stability and consistent income through interest payments post-retirement, these schemes present a compelling option. Despite the taxable nature of interest earned…

Read More » -

Investing in Mutual Funds: A Smart Strategy for Financing Overseas Education

In an era of globalized education, more students are aspiring to study abroad. However, the high costs associated with international education often lead to substantial student loans. A growing trend among forward-thinking parents and students is using mutual funds as a savings vehicle for overseas education expenses. This approach can potentially alleviate the burden of loans and set students on…

Read More » -

Difference between direct and regular mutual funds

Did you know that there are two types of plans in mutual funds in India – direct plan and regular plan. Let’s take a look at the difference between these two types of plans in mutual funds. What are mutual funds Before we dive into the differences, let’s quickly understand what are mutual funds. Mutual funds are like a big…

Read More » -

‘MF Power’ a New Mutual Fund Offering from DSIJ Private Limited

If you do not understand the complexities of the market but still want to invest, don’t worry! Mutual Fund is the best product one can opt to create wealth. There are ample types of mutual funds in the market and selecting the one that will suit your requirements and meet your needs is indeed a difficult task. It demands a…

Read More » -

LIC Nomura Mutual Fund Launches LIC Nomura MF Dual Advantage Fixed Term Plan – Series 1

Key highlights: A close ended income scheme NFO opens: Monday, June 22, 2015 NFO closes: Monday, July 06, 2015 Risk carried: Medium risk (Yellow) Plan available: Regular and Direct Entry and Exit load: NIL Payout option: Growth and Dividend payout Benchmark- CRISIL MIP Blended Index Minimum Application amount: INR 5, 000/- and in multiples of INR 1/- thereafter Investment strategy…

Read More » -

Gold Prices Climb in India on US Interest Rate Cut Speculation

Bengaluru, India – March 10, 2024: Gold prices in India have continued their upward trend for the past ten days, mirroring a global surge. This rise is attributed to anticipation of a potential interest rate cut by the US Federal Reserve. Investors are holding off on major decisions until the Fed’s stance becomes clearer. Currently, 10 grams of 22-carat gold…

Read More » -

Beat Inflation and Earn High Returns with Shriram Fixed Deposits!

Tired of watching your savings lose value to inflation? Shriram Fixed Deposits offer a safe and secure solution to grow your money. Backed by the trust of millions, Shriram FDs are perfect for anyone seeking steady returns, guaranteed growth, and inflation-beating benefits. Here’s why Shriram FDs stand out: Top Safety Ratings: Rated “[ICRA]AA+ (Stable)” by ICRA and “IND AA+/Stable” by India…

Read More » -

Robo-Advisors vs. Mutual Funds: Your Guide to Smart Investing

Choosing the right investment strategy can be overwhelming. With so many options available, it’s crucial to understand the key differences between popular choices like robo-advisors and mutual funds to make informed decisions that align with your financial goals and risk tolerance. Robo-Advisors: Automated Investing for the Digital Age What are they? Robo-advisors are online investment platforms that use sophisticated algorithms…

Read More »